November 24, 2010

Final Ratification for LTE-Advanced

Both LTE Advanced and WirelessMAN-Advanced (802.16m) are the real deal — ITU sanctioned 4G standards. Both will deliver up to 100 Mbps (mobile) and up to 1 Gbps (fixed). In order to deliver those speeds, however, both need 20 Mhz wide channels and up to 4×4 MIMO antennas on both the receiver and basestation.

In its October meeting, ITU’s Radiocommunication Sector (ITU-R) completed the assessment of six candidate submissions and reached a milestone by deciding on LTE-Advanced and WirelessMAN-Advanced for the first release of IMT-Advanced, their package of offical 4G standards.

Final ratification of the full IMT-Advanced technology family took place at the ITU-R Study Group meeting on November 22 and 23, 2010 in Geneva, Switzerland.

The standards will now move into the final stage of the IMT-Advanced process, which provides for the development in early 2012 of an ITU-R Recommendation specifying the in-depth technical standards for these radio technologies.

“This day is a milestone to remember for mobile broadband connectivity,” said Chris Pearson, President of 4G Americas. The future for mobile broadband technologies has never been brighter to help progress societies in the Americas and throughout the world.”

August 5, 2010

LTE-Advanced & IEEE 802.16m WiMAX both officially selected as 4G standard by ITU

In a meeting in Vietnam held June 9-16, the International Telecommunication Union passed the global standardization tests for the two technologies, which are intended to be used as 4G mobile communication systems.

ITU is an international organization which specializes in deciding standards on radio and telecommunications.

The organization will complete developing the specific standardization framework for the new technologies by March 2011 and grant final approval in February 2012, according to KCC officials.

“With Korea playing a key role in the international standardization effort, the nation will be able to lead the way in designing core technologies for the next generation,” said Kim Jeong-sam, director of the radio spectrum policy division at the KCC.

The two new technologies, which are already adopted by many European and Asian countries, will enable mobile phone users to get faster access to the mobile Internet at comparable speeds to Web surfing on a personal computer.

Better known as WiMAX Evolution in other countries, the WiBro Evolution’s research has been led by Samsung Electronics and the state-funded Electronics and Telecommunications Research Institute.

WiBro Evolution is deemed to be 10 times faster the high-speed downlink packet access technology adopted by the current 3G mobile phones.

The initiative for technology standardization was taken forward by the Telecommunications Technology Association in Korea, which worked in cooperation with groups based in other nations such as Japan and the U.S.

Source: Korea Herald

April 24, 2010

Is WiMAX or LTE the better 4G choice in Malaysia?

From the technical viewpoint, both are next-generation technologies for the wireless world. The choice between WiMAX and LTE hinges on the needs of the operator and the market demands, but the fact is, there seemingly is an insatiable appetite for data on the go.

WiMAX (worldwide interoperability for microwave access) is a fourth-generation (4G) telecommunications technology primarily for fast broadband.

Also a 4G mobile technology, LTE allows a peak download speed of 100 megabits per second (Mbps) on mobile phones, compared with 20Mbps for 3G and 40Mbps for WiMAX.

“For operators, the choice of technology depends on a number of things including available spectrum, legacy inter-working, timing and business focus,” says Nokia Siemens Networks head of sub region, Asia South, Lars Biese.

To deploy either technology, operators will have to commit tens of billions of dollars in network upgrades for the new mobility landscape, which now includes social, video, location-based and entertainment applications and experiences.

In many countries, the current generation of mobile telecoms networks is 3G. Those in Malaysia are deployed by the four mobile players – Celcom Axiata Bhd, DiGi.Com Bhd, Maxis Communications Bhd and U Mobile Sdn Bhd.

Biese reckons LTE is the next step for mobile networks like GSM, WCDMA/HSPA and CDMA in the move to future networks and services.

The common belief is that the natural migration path is from 2G to GPRS, from GPRS to 3G, and from 3G to LTE. But IDC Asia/Pacific’s telecom research director Bill Rojas has a differing view. To him, LTE is a totally new set-up.

“GSM and GPRS were part of a migration. In Asia, the players may put LTE on top of 3G, but this will not cover the entire population. The concentration will be on urban centres. For full coverage, the operator needs to build more than 30% new cell sites,” Rojas says.

It has been reported that LTE’s main advantage over WiMAX, in addition to speed, is that it is part of the popular GSM technology and can allow backward compatibility with both 2G and 3G networks.

LTE is relatively new compared with WiMAX. The world’s first public LTE service was made available only at the end of last year by TeliaSonera in Stockholm and Oslo.

Some people may said that LTE means "Late To Evolve"... However, LTE is fast catching up with WiMAX even though the WiMAX Forum, an industry organisation, stresses that its platform is at least two years ahead in terms of equipment availability and testing.

The Global Suppliers Association (GSA) says there are more than 59 LTE network commitments in 28 countries. In comparison, according to the WiMAX Forum, there are 559 WiMAX networks worldwide.

“To date, all existing GSM and WCDMA (3GPP) operators and CDMA (3GPP2) operators have committed to LTE as the technology of choice for their mobile network evolution, and by 2013, it is expected that there will be 20.4 million connections activated on LTE in the Asia Pacific,” says Biese.

On the other hand, YTL Communications Sdn Bhd chief executive officer Wing K Lee claims that mobile WiMAX is the only commercially proven technology that has been deployed on a large scale.

Nevertheless, market dynamics will determine the outcome of the race.

There are four WiMAX spectrum holders in Malaysia, namely, Packet One Networks (M) Sdn Bhd, REDtone International Bhd, Asiaspace Sdn Bhd and YTL Communications, which is the only one that has yet to roll out services commercially.

Rojas of IDC says both technologies can co-exist, but to him, WiMAX is still the purest 4G network. Naturally, the promoters of LTE have the opposite view.

That aside, Lee of YTL Communications points out that LTE and WiMAX serve the wireless broadband market and both technologies fundamentally share the same technological foundation. Therefore, they have more similarities than differences.

Should they then be merged, as suggested by US-based Clearwire CEO Bill Morrow, given the overlap in the technologies?

While the debate rages on, the mobile operators in Malaysia still have a little bit of time to decide on which route to take to add capacity. This is because they have not fully exhausted their 3G spectrum. Even the WiMAX players have not fully exploited their 2.3G spectrum.

At some point, Rojas believes, the Malaysian Government will have to decide on spectrum allocation for LTE. Until then, do not expect the operators to fast-track their network expansion, even though some may face bottlenecks soon.

Furthermore, the Government needs to be certain that LTE is what the market needs. “Without (additional) spectrum after 3G, operators will have to move to LTE using the 3G spectrum,’’ Rojas says.

Whatever is on the minds of the players and industry regulators, one thing is clear – the need for speed is growing by the day, and the planning for spectrum allocation should start before we hit bottlenecks.

Some industry players have also called for the Government to refarm spectrum so that there is a coordinated approach to spectrum allocation and assignment. Not that there isn’t, but given that spectrum is becoming a rare commodity, the Government should make sure that the spectrum awarded is put to good use.

Rojas expects major commercial roll-outs of LTE and WiMAX in Asia this year and next, but devices remain an issue in the world of 4G. At the same time, experts say it is about time that the industry focuses on a single device that works on all platforms.

March 29, 2010

WiMAX Public Key Infrastructure (PKI) (X.509 certificates)

March 24, 2010

WiMax vs. LTE: Which Will 'Win' in a Fast Deployment Cycle?

It will be an interesting process as the two approaches – Long Term Evolution (LTE) and WiMax – vie for supremacy. The die already seems to be cast, however: WiMax, through Clearwire and its Clear service, is first out of the gate. LTE, however, through its use by Verizon and AT&T, seems positioned to be the dominant player when the dust settles.

WiMax suffered a bit of a blow earlier this month when Cisco decided not to build radios for the platform:

…WiMax is making strides with at least one significant niche category: smart grid networking. Earth2Tech reports that startup Arcadian Networks has released the AE20r gateway, a WiMax-focused device. The story says that Arcadian, which owns spectrum in the middle of the country, sells smart grid services to utilities. The story notes other vendors in the smart grid/WiMax arena, including Grid Net, General Electric, Alvarion and National Grid.

LTE is particularly active on the international front. ABI Research says that as of the end of September, 100 mobile networks were holding trials or were set to start. More than 40 of the trials are ongoing in the Asia-Pacific region – led by Japan and South Korea, with 33 contracts awarded. ABI Research says that though the first networks won’t start commercial operation until the end of next year, a robust 32.6 million subscribers will be served by LTE by 2013. The pressure is so great that many operators are taking the interim step of upgrading 3G networks to High Speed Packet Access (HSPA) status.

October 23, 2009

The Future of 4G: LTE vs. WiMAX

Verizon, however, has committed to rolling out LTE (Long Term Evolution)... (in joking mode they called it as "LTE: Late to Evolve") starting next year, delivering ten times the data throughput of current 3G technologies. Others, including NTT DoCoMo in Japan, France Telecom, Vodafone in the UK, AT&T, and T-Mobile, have also said they will adopt LTE rather than WiMAX.

Meanwhile, Sprint, Clearwire, and Comcast in the U.S., UQ Communications in Japan, and Yota in Russia are all aggressively rolling out mobile-capable “4G” networks using the current version of WiMAX, 802.16e (2 to 10 Mbps), in urban markets where they will inevitably compete with 3G (and later, LTE) providers.

The WiMAX Forum claims that 504 operators in 145 countries have deployed WiMAX, but many use older 802.16d technology that cannot provide mobile services, and many are small operators in developing countries or rural regions.

How will the market unfold? Are LTE and WiMAX on a collision course? If so, which will prevail. Or will the two technologies co-exist, even complement each other? The answers are far from clear, and depend to a large extent on who you ask.

Defining “4G”

The ITU, the International Telecommunications Union, is developing specifications for 4G mobile. Neither WiMAX, 802.16e, nor the current LTE standard, revision 8, meet basic preliminary objectives for 4G, said Phillip Redman, a vice president of research at consulting and analyst firm Gartner Inc.Sprint and Clearwire’s use of the term 4G to describe their 802.16e technology does not reflect adherence to international standards, Redman pointed out. It refers to the fact that this is the fourth generation of mobile wireless technology deployed in North America.

How and when either camp will deliver a standard that does meet the yet-to-be-finalized ITU specs remains to be seen. It is anticipated that LTE will get there with revision 10 and WiMAX with a projected 802.16m. Estimates of when equipment based on these advanced standards will appear ranges from 2011 to 2015.

Despite the similarities of the two technologies, and despite suggestions from some that the two camps are notnecessarily on a collision course, discourse between and around them can get heated.

In this corner

Redman wrote in a report last year, "WiMAX drives the hype for 4G, but LTE will be the dominant standard," A WiMAX skeptic and a perceived thorn in the industry’s side, he believes LTE’s dominance is not a question of technological superiority or even cost, but of market politics.“Politics rules everything,” he said, explaining the reasons so many major mobile operators chose LTE rather than WiMAX as their upgrade path to 4G.

Those operators—Verizon, AT&T, NTT, et al—didn’t really choose the technology, Redman believes. They chose their suppliers: Ericsson and Nokia, tried-and-true Tier 1 mobile infrastructure equipment manufacturers that had decided not to back WiMAX.

If operators wanted to go with WiMAX, they had to bet on smaller Tier 2 suppliers, such as Motorola, Alcatel-Lucent, and Alvarion. “It’s all about who you feel most comfortable with,” Redman said. Better the devil you know?

The Tier 1 suppliers, in turn, backed LTE over WiMAX because they saw that, for a variety of reasons, they could make more profit selling LTE. “In many cases, it was more a political decision than one based on technology or cost,” he said.

Redman has reportedly gone as far as urging businesses to hold off on investing in WiMAX, at least until the equipment ecosystem evolves to make dual-mode 3G-WiMAX devices more readily available.

This enraged some elements in the WiMAX camp. One Intel blogger characterized Gartner’s analysis of the market as “the most recent attempt at ‘drive-by kneecapping’” of the technology.

When we repeated to Proulx Redman’s suggestion that WiMAX vs. LTE might be analogous in some ways to the showdown between VHS and Betamax video cassette formats in the 1970s—with WiMAX taking the doomed Betamax role—her response was blunt.

“It’s a silly analogy and it’s unfortunate it’s been repeated so often,” she said. Proulx noted that Betamax was a proprietary technology, backed by one supplier (Sony) and was more expensive than its competitor—none of which is remotely true of WiMAX.

Proulx was similarly direct in responding to Redman’s suggestion that 802.16m is a more uncertain proposition than LTE Rev 10 and may not even be backward compatible to 802.16e. “From day one,” she said, “the first [design] requirement [for 802.16m] was that it be fully backward compatible. I think you’ll see evidence of that very soon.”

Chua apparently does not raise the ire of the WiMAX community to the same extent as Redman, but his perspective is not so different.

IDC believes operators rarely have made or will make either/or choices between LTE and WiMAX. More often, decisions will be made for them because only one technology or the other can meet all their needs—given time-to-market, desired business model, and other considerations.

“We characterize WiMAX and LTE as two circles that overlap,” Chua said. “Inevitably there will be some competition, but competition is not the overriding market scenario. It’s not what defines those two markets.”

Going to market

That said, he too believes WiMAX will have a tough time overcoming market factors arrayed against it. He argues that LTE will be building from a customer base of 4.6 billion mobile users worldwide, while WiMAX mainly has appeal as a replacement for DSL, especially in developing markets where wireline broadband technologies are not available. It will be building from a much smaller base: fewer than a billion customers worldwide.IDC will publish a forecast later this year showing sales of LTE equipment surpassing WiMAX equipment sales some time in 2012.

But it may not be as simple as 3G mobile users in developed markets sticking with their current providers and waiting for LTE (because of LTE is "Late To Evolve"), while WiMAX is relegated to a niche role delivering portable rather than mobile service in developing countries and rural regions.

For one thing, the WiMAX camp believes the momentum it’s currently building in those developing markets will drive development of an ecosystem, help harden the technology—and put it in good position to be a full competitor in the 4G mobile market down the road.

Indeed, the fact that WiMAX lets operators in those markets start small and build businesses organically without investing billions of dollars is one of its key advantages over LTE, Proulx said. Operators may start by providing DSL replacement services, but can easily evolve to offering true mobile services when they have the breadth of coverage and market demand.

And then there are the implications of exceptional initiatives in more developed markets—Clearwire in the U.S., Yota in Russian, UQ in Japan. Yota is currently signing up 2,000 new subscribers a month in St. Petersburg and Moscow and already has 200,000 since launching last fall, Proulx said.

While Clearwire has been slow to introduce WiMAX-powered phones or dual-mode 3G-WiMAX phones that would help it attract customers away from 3G providers, Yota is already building much of its marketing around a dual-mode device from HTC.

Most observers agree that the winners in the 4G market will be those that offer the widest coverage, the most reliable service and the best choice of devices. Redman is skeptical Clearwire can build its network out quickly enough to give it the breadth of coverage needed to attract 3G customers. The company will need another big infusion of capital next year just to continue its current pace, he added.

But Proulx believes WiMAX can compete with 3G operators, if not immediately in the U.S. then soon—and perhaps sooner in Japan. There, she said, UQ expects to have 90% of the Japanese population covered by its network by the end of 2010. If true, that would be before NTT is even out of the gate with LTE.

Redman and Chua may be underestimating the market strength of WiMAX—or not. Either way, no one is seriously suggesting it will be blown out of the water by LTE. The two will co-exist, whether or not peacefully remains to be seen.

Indeed, the picture is unclear and may be no clearer until 2011 when commercial services using both will be available in the U.S. and elsewhere. Stay tuned.

May 10, 2009

WiMAX vs LTE: The 4G Wireless Network Battle

February 5, 2009

Malaysian broadband information

- Wimax - currently used by packet one(P1), YTLcomms, AMAX, REDtone

- HSPA - known as 3.5G, currently used by MAXIS, Celcom, DiGi, UMobile

- LTE - known as next generation of hspa by 3gpp, theoretically can up to 100Mbps download and 50Mbps upload.

- iBurst - currently used by izzi

November 25, 2008

WiMAX Roaming Check List

As a first step to enable roaming, two WiMAX operators which desire to provide roaming service on each others’ networks must share information about their specific requirements and capabilities. This is an important step in determining whether their networks will support roaming services for each others’ subscribers. This includes information regarding frequency bands, devices, services and protocols. For example, devices of a WiMAX operator must be capable of operating on the frequencies and within the channel bands of their roaming partner. Two operators must also agree on services to be provided, IP address assignment mechanism, method of interconnection and the format and method for sharing information to track subscriber usage and to exchange information required for billing and settlement.

The following is a check list of items to be completed in order to implement roaming.

Identify and contact roaming partners.

Operator Information – to be shared with potential roaming partners to determine compatibility for roaming (see list below).

Decide whether roaming will be through a direct connection with the roaming partner or via a third-party roaming exchange provider (WRX). If through a WRX, establish relationship with WRX provider.

Use WiMAX Roaming Guidelines and Roaming Specifications as reference in ensuring your network is roaming capable.

Establish a Roaming Agreement with roaming partner. (Roaming Agreement Template)

Establish connectivity with roaming partner.

Test roaming service (Test Plan).

Begin service.

October 23, 2008

WiMax Vs LTE : future mobile communication trend ?

WiMax is based on a IEEE standard (802.16), and like that other popular IEEE effort, Wi-Fi, it’s an open standard that was debated by a large community of engineers before getting ratified. In fact, we’re still waiting on the 802.16m standard for faster mobile WiMax to be ratified. The level of openness means WiMax equipment is standard and therefore cheaper to buy — sometimes half the cost and sometimes even less. Depending on the spectrum alloted for WiMax deployments and how the network is configured, this can mean a WiMax network is cheaper to build. The speed for the WiMax (802.16) is up to 70 Mbps, while the mobile WiMax (802.16m) is up to 100Mbps.

Malaysia is still in progress in deploying WiMax Technology, but the condition is stillon “testing” for so long . Do not know why. Izzi is a new name in Malaysian Broadband challange and the claim to have 4G connection. Check it first before you subscribe (affraid only for the best effort - as another slumpy monopoly carrier advertise their broadband). Sprint Nextel will aslo deploy this WiMax technology to become their 4G carrier.

Whilst, The LTE, (3GPP Long Term Evolution), is the next-generation network that beyond 3G. In addition to enabling fixed to mobile migrations of Internet applications such as Voice over IP (VoIP), video streaming, music downloading, mobile TV and many others, LTE networks will also provide the capacity to support an explosion in demand for connectivity from a new generation of consumer devices tailored to those new mobile applications. Most of the Telcos believes LTE will be the standard chosen by 80 percent of the carriers in the world

LTE is the natural evolution of 3GPP GSM and WCDMA networks. It is also an evolution candidate for 3GPP2 CDMA networks. Efforts are underway to harmonize the standards. LTE itself is a new paradigm in access, with a new modulation technique, OFDM (Orthogonal Frequency Division Multiplex) or some people said it use Orthogonal Frequency Division Multiple Access (OFDMA), and antenna technology, MIMO (Multiple Input Multiple Output).

Nortel, Nokia , LG, and Alcatel-lucent are among the group who perform test on LTE deployment.

To much technical right?

The funny thing about technology businesses is that technology counts for so little in the final result. Politics, human nature, and all of the frailties inherent therein trump the technology issues in virtually every case. So, logically: LTE will win.

The cellular carriers control the market, so they control the decision. Now if the WiMAX camp could come up with something that was phenomenally better, then the cellular carrier would have to look more closely at this, but unfortunately, physics works the same for everyone. With no compelling technical advantage for WiMAX, LTE will win. Agree?

April 7, 2008

WiMAX Forum Congress Asia 08

Show Opening Times

Wednesday 9 April, 2008

08.00 - 18.30

Thursday 10 April, 2008

08.00 - 17.30

If you have not yet registered for your free exhibition pass it is not too late. Click here now to register, giving you access to over 80 key WiMAX players from across the whole ecosystem and 10 hours of FREE educational content at the FREE seminar program.

Designed for the entire WiMAX eco-system, WIMAX Forum Congress Asia will set the agenda and the critical business relationships for the mobile broadband industry.

WiMax vs WiFi

WiMax base stations will have the ability to provide approximately 60 businesses with T1 access and hundreds of homes with DSL/Cable speed access…in theory. Engineers are stating that WiMax has the capability of reaching 30 Miles but real world testing has shown 4-8 mile working radius.

WiMax (MAN) deployments are similar to a WiFi network. First the ISP would have their T3 or higher access. The ISP would then use line of sight antennas (Bridges) to connect to towers that would distribute the non line of sight signal to (MAN) residential/business clients.

WiMax line of sight antennas operate at a higher Frequency up to 66mhz. Distribution antennas do not have to be in the line of sight with their clients. Non – line of sight towers operate on a range similar to WiFi . WiMax can operate right next to cell phone towers with no interference.

WiMax networks are similar to Wifi in deployment. The Wimax Base station/Tower will beam a signal to a WiMax Receiver. Similar to a WiFi access point sending a signal to a laptop. As far as I can tell laptops will be shipping with Wimax receivers in 2006.

QOS (Quality of Service) is an major issue with WiMax because of the number of people accessing a tower at once. Some would think that a tower could be easily overloaded with a lot of people accessing it at once. Built into the WiMax standard is an algorithm that when the tower/base station is nearing capacity then it automatically will transfer the user to another WiMax tower or cell. Unlike a Wifi clients who have to kind of fight to stay associated with a given access point; WiMax will only have to perform this hand shake at the MAC level the first time they access the network.

WiMax is designed for building a network infrastructure when the environment or distance is not favorable to a wired network. Also, WiMax is a cheaper and quicker alternative than having to lay wire. Third world countries will greatly benefit from deploying WiMax networks. WiMax can handle virtually all the same protocols Wifi can including VOIP. African countries are now going to start deploying WiMax networks instead of cell phone networks. Disaster zones can also utilize WiMax giving them the ability to distribute crisis information quickly and cheaply.

Militaries are already using wireless technology to connect remote sites. Logistics will be simplified with the ease of tracking with RF technologies. WiMax can also handle Webcams and streaming video which would give commanders eyes on target capability. Just imagine if planes were able to drop preconfigured self deploying WiMax antennas in strategic areas giving troops real time battlefield intel. Armed with wireless cameras, drones and a GPS one soldier would truly be an Army of One.

As WiMax is deployed in more areas theory and real life capabilities of WiMax will come to light. The differences between WiMax and Wifi are simple. Think of a WiMax network as an ISP with out wires, with the signal providing your internet access to your business/ home. Wifi will be used within in your LAN for the near future.

Eric Meyer writes about networking wireless technology. Visit his blog here.

November 5, 2007

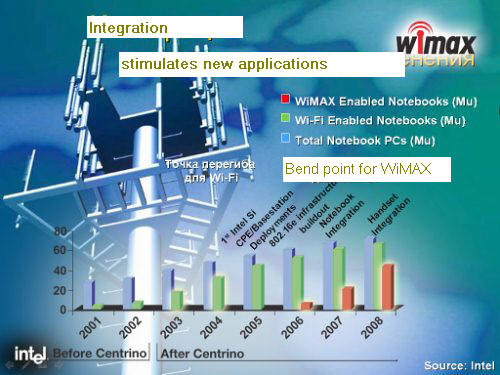

WiMAX expected to supercharge wireless applications

WiMAX could be the technology that fuels the fusion of all sorts of mobile applications, integrating video, location-based services and a host of other offerings.

And analysts generally agree that speedy access to the wireless Web will be the key.

“When I talk WiMAX, I always quote my boss Sean Maloney,” said Ron Peck of Intel Corp., referring to the company’s general manager of sales and marketing. “If you’re pitching WiMAX, you must repeat: the mobile Internet is the next big thing.”

It’s no secret that WiMAX offers a combination of wide coverage, high capacity and low latency rarely seen—if not unprecedented—in wireless. The technology is claimed to top out at 70 megabits per second and delivers a footprint of as many as 37 miles under ideal conditions (although not simultaneously—like DSL, the network’s speed is influenced by its reach, and vice versa).

Actual network speeds are likely to average between 2 and 4 Mbps, according to operators. But even on the low end, WiMAX appears to be speedier and offer more capacity than 3G networks.

Fat pipe for hungry users

That combination means more than just connecting lots of users more efficiently, according to Daryl Schoolar, a senior analyst with In-Stat. It means more consumers can consume more data, more quickly.

“From everything I’ve been told by vendors who make both WiMAX and cellular equipment, WiMAX has significantly lower lag,” said Schoolar. “They also tell me it can support more connected users. That would certainly lend itself toward real-time apps such as streaming apps.”Which is why WiMAX is expected to give birth to a host of connected devices dedicated to a single use. Not only is the technology likely to serve as a catalyst for the production of mobile music and video players, it will provide connectivity to consumer electronics such as cameras, camcorders and gaming devices—devices that don’t traditionally offer network access.

Taking advantage of WiMAX

But even as it sparks an increase in the number of dedicated devices, WiMAX is predicted to provide a boost to converged devices. Just as 3G networks and GPS technology has provided a platform for developers to build compelling applications that deliver both relatively low latency and remarkably accurate location information, WiMAX’s speed and capacity could prove ideal for offerings that fuse a number of different applications.

“I think you’re going to see a lot of the video side of the Internet,” said Peck, including video-sharing and other mobile social networking features. “I also think you’re going to see a ton of visual apps” that integrate video with location-aware applications, games and other offerings.

Other possibilities include teleconferences that include both video and Web-based applications, and multiplayer games that feature GPS location information and nearly real-time play.

And while WiMAX may suffer in urban environments—where indoor usage may slow the network to the lower range of expected speeds even when a tower is relatively nearby—the technology will work hand-in-hand with Wi-Fi and other channels of connectivity, Peck said.

Questioning Wi-Fi

Wi-Fi is “stupid,” according to Peck, and simply offers a connection without taking other technologies into account. But WiMAX is “very smart” and can hand users off if a more efficient network is available. So consumers could surf the Web or sit in on a multiplayer gaming session on WiMAX on the commute home, then automatically switch to Wi-Fi when they get indoors.

So the new technology may provide a platform that not only serves as a high-speed highway, it will allow devices to take detours whenever backups occur. Developers will scramble to leverage WiMAX, Peck predicted, throwing all sorts of applications at the wall to see what sticks.

“I think it’s going to be the wild, wild West,” Peck predicted.

Big players have big plans for WiMAX

Consider WiMAX a bit schizophrenic. The technology is taking two divergent paths as different countries and different companies explore how best to put it to use in their respective markets.

Dr. Mohammad Shakouri, board member and VP of marketing for the WiMAX Forum, has described the technology as serving “the richest of the rich and the poorest of the poor” as companies lay out strategies that include either a high-end focused, consumer electronics play or a wireless broadband provider for the masses and in rural areas.

Both strategies are playing out in the U.S. market, but the space is dominated by three major players with large spectrum holdings in the 2.3 GHz and 2.5 GHz bands: AT&T Inc., Clearwire Corp. and Sprint Nextel Corp.

Sprint Nextel and Clearwire have been overshadowing the conversation of late, first appearing to operate on separate tracks and then announcing a partnership that is supposed to speed the deployment of mobile WiMAX as well as ease the burden of network costs for each respective company. The corporations have outlined a plan in which Sprint Nextel will build out 70% of the initial 100 million potential customers to be covered, while Clearwire builds out 30%. Sprint Nextel has outlined plans for a wide variety of consumer electronic devices to make use of the new network and also hinted at allowing wholesale agreements that could boost WiMAX traffic.

Sprint Nextel’s bet

Sprint Nextel has been outpaced in the traditional wireless market by Verizon Wireless and AT&T Mobility in subscriber growth and customer metrics, and it is betting that changing the nature of the competition will give it an advantage.

“It’s very difficult to change the balance of the subscriber bases right now in the U.S.,” said Moe Tanabian, analyst with IBB. Given Sprint Nextel’s customer and financial issues, he said, “they have to do something drastic. … They’re relying on this assumption—it may turn out to be true—that we’re moving from voice-centric wireless consumption to a data-centric wireless consumption” during the next three to five years.

Tanabian noted that Sprint Nextel first began its WiMAX push by aggressively talking up the technology and laying out ambitious plans—and that it has since toned down its approach a bit.

“They started to see things are not as rosy as they thought,” Tanabian said—and that led to the choice of Clearwire as a partner for WiMAX. The two companies plan to cooperate on services and branding under the Xohm brand name.

Clearwire’s upward mobility

For Clearwire, meanwhile, the announcement of the Sprint Nextel deal has catapulted it from an untried, small competitor into one that can play in the ranks of the top four wireless operators. It opens up the ability for the company to reach a vast potential customer base of 100 million people and to augment its coverage initially through use of Sprint Nextel’s cellular network.

Tanabian also noted that the company recently announced distribution agreements with satellite television providers DirecTV Group Inc. and EchoStar Communications Corp. that would enable it to fashion a triple-play bundle of services.

“They’re trying to diversify their business model,” Tanabian said. “So if for whatever reason the device ecosystem doesn’t develop as fast as they think it will, they still have other means of forging a business.

“Clearly, Clearwire was the winner from this deal—although Sprint won as well, by turning a foe into a friend and just getting rid of that headache. But Clearwire, it was just pure, sweet sugar for them.”

AT&T in Alaska

AT&T declined to speak about its plans for its holdings in the 2.3 GHz bands. However, the company did issue a statement on its strategy related to WiMAX, noting its deployment this summer in Alaska and apparently taking the path of using WiMAX to extend broadband coverage rather than push new technology.

“AT&T has been heavily involved in the development of emerging technologies like WiMAX and Wi-Fi mesh networks, which bring strong potential for extending and expanding customers’ ability to access broadband connections. The company has played a leading role in development of emerging WiMAX standards, and has launched 22 limited deployments and trials of WiMAX and other fixed wireless technologies to date, eight of which remain in operation as commercial offerings today,” said AT&T spokeswoman Jenny Parker.

Parker added that AT&T Alascom had announced its latest deployment of WiMAX in Juneau, Ala., in July and that it “plans to deploy WiMAX-based broadband in additional Alaska markets in 2008.”

“Outside of Alaska, AT&T will evaluate further opportunities to deploy WiMAX and other fixed wireless technologies based on customer needs and the results of its existing technical and commercial deployments,” Parker said.

Those opportunities could also include the bucket of 700 MHz spectrum AT&T Mobility recently acquired from Aloha Partners L.P. for $2.5 billion. The spectrum, which is near the 700 MHz spectrum the government is scheduled to begin auctioning early next year, gives the industry’s No. 1 player a deeper spectrum portfolio covering nearly 200 million potential customers across the country.

The carrier said it has yet to decide how to use the spectrum, but with its enviable propagation characteristics, you can bet it will be for an important service.

“We’ll use the spectrum either for broadcast mobile or two-way voice and data services, but not both,” AT&T Mobility spokesman Michael Coe recently said. “We’ll make that determination based on what’s best for our customers.”

November 1, 2007

WiMAX today and tomorrow

WiMAX today

Despite the all-round occurrence of the WiMAX still in the design even in the most developed countries, introduction of the standard is progressing at an enviable pace. Quite recently, last autumn during the days of Intel Developers' Forum in the building of Russian Academy of Sciences the experimental network IEEE802.16-2004 was demonstrated in action. And last week in Kiev, Ukraine, Ukrainian advanced technologies commissioned the first in the ex-USSR network of wireless broadband access to Internet on the base of the WiMAX technology. From that week onwards, the network by "Ukrainian Advanced Technologies" dubbed ALTERNET started rendering services of wireless broadband access to Internet on the base of WiMAX using client devices built on the Intel PRO/Wireless 5116 chipset.

The services are about fixed wireless access to Internet using the WiMAX technology based on the Alvarion client equipment built on the Intel PRO/Wireless 5116 chipset. They are offered to companies and private persons who are based in the areas of poorly developed or outdated cable infrastructure. "Ukrainian Advanced Technologies" intends to provide its services on a turn-key basis in merely two days after the first customer's call. Today, you can subscribe to the services in Kiev and Kharkov. There are plans for the first quarter of the next year to establish regional offices to render the access services in Dnepropetrovsk, Odessa, Donetsk, and Lvov. On the whole, it is planned to provide WiMAX connection facilities in all the regional centers of Ukraine by the end of 2006.

In fact, you shouldn't think that some sort of a WiMAX anomaly is going on in the Ukraine. Introduction of WiMAX networks is going on continuously these days, announcements of launching such networks are appearing every day, and only in Russia this issue is being solved extremely slowly (read below).

Modern hardware for WiMAX

As regards the capabilities of PRO/Wireless 5116 chipset officially presented by Intel in April 2005, it proved to be one of the first products in the industry with support for the WiMAX standard. This Intel chipset is made in a 360-pin PBGA casing, offers functionality needed to implement establish economical high-speed wireless modems for the home and office. Solutions based on PRO/Wireless 5116 allow providing broadband access to the Internet in remote areas where no DSL or cable networks are there and establish communication between tasks distributed a few miles apart.

Combined with a RF module and a third-party amplifier, the SoC system Intel PRO/Wireless 5116 with support for IEEE 802.16-2004, formerly known as the Rosedale, provides the possibility to use WiMAX networks for a wide circle of users.. At the same time, the Intel PRO/Wireless 5116 interface supports not only external but internal solutions, e.g. WiMAX subscriber modems and home-based gateways.

Intel PRO/Wireless 5116 (Rosedale)

WiMAX Forum. Intel's role in establishing the standard

For the purposes of testing, standardization, certification and marketing of WiMAX products, the WiMAX Forum industry alliance has been established. It's just this alliance that issues "WiMAX Forum Certified" verdicts. By now, the number of WiMAX Forum members is rapidly approaching to 200, and over one quarter of the number are operators who are rendering provider services based on the WiMAX technology.

Once of the most active member of the WiMAX Forum alliance is Intel who participates in all the undertakings – from problem statement up to the ratification of standards and development of end equipment. Intel is now cooperating with companies who have deployed pre-standardized WiMAX broadband wireless networks in over than 125 countries. They offer a wide range of options - from stationary systems of wireless access up to enterprise-scale point-to-point data transmission systems.

For the purposes of testing, standardization, certification and marketing of WiMAX products, the WiMAX Forum industry alliance has been established. It's just this alliance that issues "WiMAX Forum Certified" verdicts. By now, the number of WiMAX Forum members is rapidly approaching to 200, and over one quarter of the number are operators who are rendering provider services based on the WiMAX technology. Apart from Intel Corporation, other known companies participate in the WiMAX Forum, among them Airspan Networks, Alvarion, Aperto Networks, Ensemble Communications, Fujitsu Microelectronics America, Nokia, OFDM Forum, Proxim Corporation, Wi-LAN Inc. and others.

One of the most active member of the WiMAX Forum alliance is Intel who participates in all the undertakings – from problem statement up to the ratification of standards and development of end equipment. Intel is now cooperating with companies who have deployed pre-standardized WiMAX broadband wireless networks in over than 125 countries. They offer a wide range of options - from stationary systems of wireless access up to enterprise-scale point-to-point data transmission systems.

Among the operators collaborating with Intel at the promoting of WiMAX solutions are AT&T (USA), Altitude Telecom (France), BT (U.K.), Brazil Telecom (Brazil), ETB (Columbia), Iberbanda (Spain), Millicom (Argentina), Qwest (USA), Sify (India), Speakeasy (USA), Telkom (South Africa), Telmex (Mexico), TowerStream (USA), and the already mentioned "Ukrainian Advanced Technologies" (Ukraine). The release of produce manufactured on the base of Intel PRO/Wireless 5116 has been announced by Airspan, Alvarion, Aperto Networks, Axxcelera Broadband Wireless, Gemtek, Huawei, Proxim Corporation, Redline Communications, Siemens Mobile, SR Telecom, and ZTE.

Remarkably, these days Motorola and Intel announced their joint plans for promoting the IEEE 802.16e-based WiMAX technology for mobile solutions and which is applicable to both stationary and wireless devices fir broadband communications. Apart from promoting the WiMAX standards, the joint plans of these companies include tests of mobile devices, networked and subscriber end equipment made by Motorola for compatibility to Intel's produce.

WiMAX in Russia

Late in October, the first in Russia seminar on using the WiMAX arranged by Intel was held in Nizhny Novgorod. The seminar gathered representatives, telecommunication companies, providers, developers and manufacturers of wireless communications equipment, as well as government institutions in charge of frequency regulations and licensing. During the event, Intel representatives demonstrated a model of operating network built on the base of the Intel Pro/Wireless 5116 chipset.

Alas - not all are as enthusiastic as Intel. As regards the real dates for introduction of a new backbone wireless standard in Russia, many analysts agree that formation of WiMAX networks in Russia will not start earlier than the summer of 2006. Many pledge to the incomplete certification for WiMAX equipment, many complain about the high price of first-generation WiMAX solutions, but in general there is a lack of intention from the side of providers to spend for a technology which is unlikely to pay back soon. In large cities where there are still more than enough facilities for fast-speed Internet access, the Wi-Fi capacity is still enough. As regards deployment of WiMAX networks somewhere in remote areas in Russia, no one is yet planning to do so at the first stage. Of course, there will be isolated instances of WiMAX network deployment, but we won't hear about them in the near future. But while there is little interest from administrative bodies and lack funding all these events will still be unique.

In a word, many agree that WiMAX networks are unlikely to go beyond the boundaries of large Russian cities earlier than 2009. At the same time, in the Net you can find a variety of contrary opinions stating that if introduction of WiMAX networks at the first stage proves successful, their number may go up as a snowball within short terms.

Perhaps I'd rather stop my today's story at the note of uncertainty. Early in 2006, the WiMAX standard is in for another epochal event and we'll hope that by that time the news on Russian market of WiMAX networks will be more optimistic.